The 411 on Starting a Car Donation Program

A car donation program is a great way for a nonprofit to expand its donor base and provide new ways to involve existing donors and volunteers.

How to make a car donation program work for your nonprofit.

Does your radio station advertise for car donations? Blue Avocado reader Eric Haynes knows all about it — his Kansas City nonprofit accepts car donations and he’s here with the inside story and how – surprisingly – to make it work on a modest scale for you.

Do you remember your first car? As I approached my 16th birthday, I daydreamed about the hot rod that would rocket me to the top of the high school social order, and rock my nights with its hi-fi stereo system.

My dad, on the other hand, had no consideration for my social status: he found me a rusting station wagon! I nearly gagged at the sight of the oversized nerdmobile.

Stepping Into the Car Donation Fray

Families greet their teenager’s first car with excitement and trepidation; nonprofit people receiving their group’s first donated car often feel much the same way.

While there are the large, national organizations that liquidate thousands of vehicles per year at auction (and are the target of much controversy — see Get the 411 on Car Donations) most nonprofits that accept cars are community organizations that are given two or three or five cars a year.

Community nonprofits (like Hillcrest Transitional Housing where I work) obtain donated vehicles:

- to liquidate/sell the cars for cash

- to use the vehicles in service programs (delivery van at a thrift store); or

- to give the vehicles to clients (a homeless mom in need of transportation to seek work).

Why would a donor want to give away a car?

Some thoughtful donors appreciate how useful a car can be.

“I could have sold those cars and donated the money, but the organization couldn’t have purchased a car of the same value with the cash contribution,” says Gregg Hejna, who has donated two vehicles to our organizations. “Donating dollars is more efficient, but sometimes a donated service or product is more effective.”

Whether your organization is approaching the on-ramp to vehicle donations or looking to improve miles-per-donation on an existing, large-scale campaign, I encourage you to review four tips before shifting into a higher gear:

1. Kick the tires: What’s the most effective way to handle the process?

First decide whether driving the campaign yourself or hiring a chauffeur would work best. Numerous for-profit businesses and nonprofit organizations act as brokers, providing services to manage vehicle donations, including towing service for nonoperational vehicles. Most will process all of the paperwork (which really isn’t difficult) and liquidate the asset at an auction (often for a small percentage of the selling price).

Keep the donation process simple, and make it easy to contact your organization (whether through a website or dedicated phone service). If you go with a third-party liquidator, get references and check their reputation. Make sure they have a stated privacy policy and that they clearly tell the donor the amount of proceeds going to your organization. There are some unscrupulous businesses hoping to make a fast buck and will think nothing of taking advantage of your donor base. Do your research!

2. Look at the Blue Book: Is it worth accepting the vehicle? What is the value of the donation to the donor?

In an environment where uneducated donors give expired medicines to a homeless shelter (happens more often than you think), bear in mind that donors often overstate the true value of their donation. Nostalgia and past maintenance expenses may inflate the value in the minds of some donors; others are simply attempting to pad their tax deductions. Such abuse has led to significant changes in the tax rules. Donors can no longer self-assess the value of a vehicle that is to be liquidated; they must receive a receipt from the nonprofit stating the vehicle’s sale price. For vehicles to be used by the nonprofit for its own purposes, self-valuation is handled by the donor as a normal in-kind gift (always advise donors to consult a tax professional).

3. Check for blind spots: What are the costs of receiving vehicle donations?

It sounds like a no-brainer to accept all in-kind gifts, but be sure to consider all costs associated with marketing, accepting, and processing donations (including fuel, transportation, storage, and securing vehicle titles).

It is important to consider the time costs of accepting a vehicle that is nonoperative, has significant maintenance needs, or is worth only salvage. Time spent by volunteers and staff can quickly eat up any financial gain to be had from the sale of a junker that was used up by a donor’s teenage son. A thorough walk around of the process prior to embarking on a major campaign will help reveal potential blind spots.

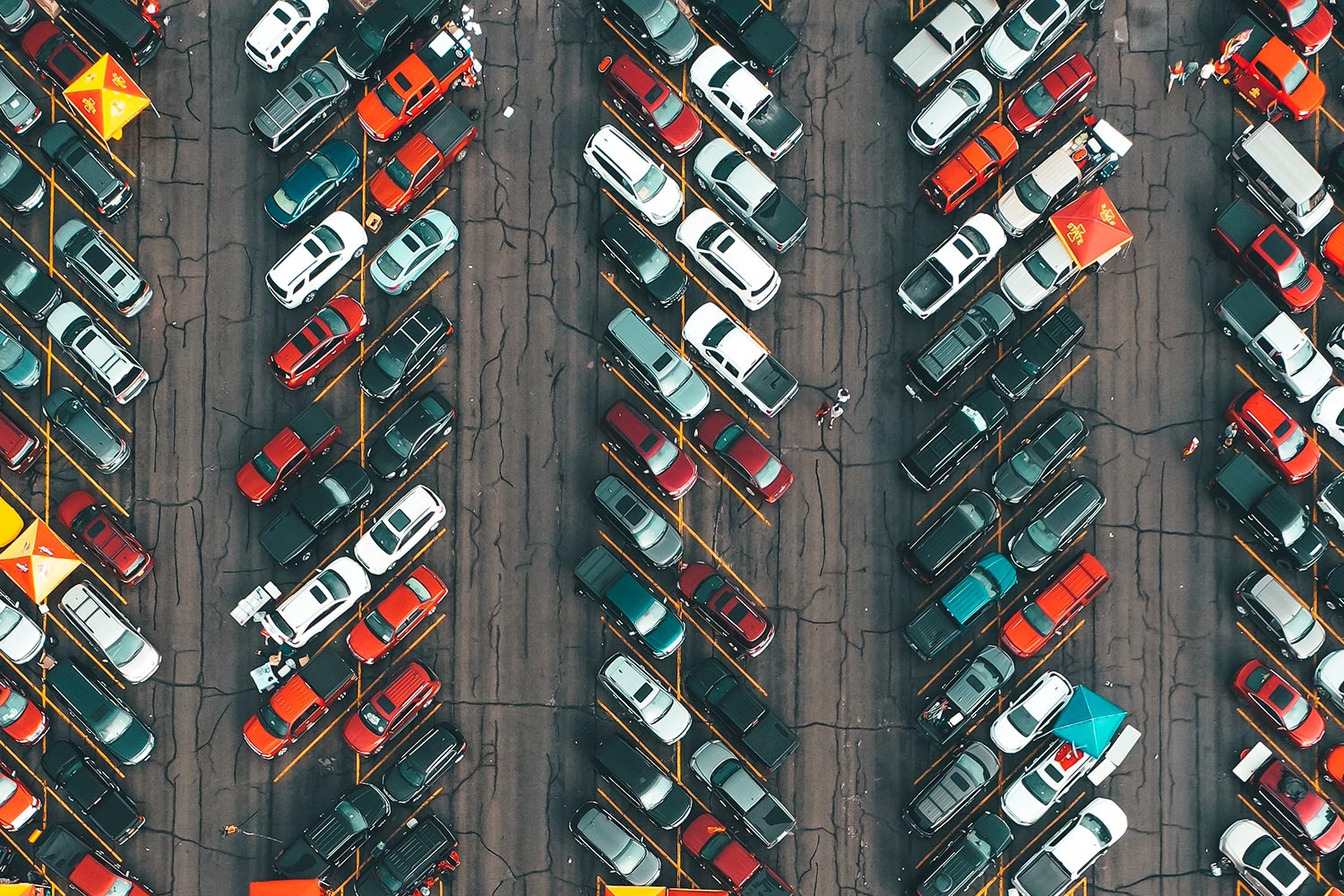

Storage can be a significant issue. Our organization received notice from the city when the street and yard began to resemble a used car lot while we processed a wave of donations and waited for titles to arrive in the mail.

4. Check the odometer: How many miles of use do you need out of the vehicle?

A car on its very last legs, coughing fumes as it wobbles down the road, is not an acceptable vehicle for use by a family in need, but may be of value to a salvage yard. I learned this the hard way after I picked up a stranded mom and her three kids when the older car that we had “gifted” her with collapsed within one month of receiving it. Luckily, another donor came in with a minivan that is still running strong after two years. The ultimate purpose of the vehicle will determine what type of vehicles you should accept.

Like the teenager with his first car, a nonprofit takes an exciting step toward maturity when it accepts its first vehicle donation. Limiting solicitations to cash donations is akin to hanging out at the local go-cart track when you could be in the Indy 500. Nonprofits spend nearly 90 percent of their time soliciting cash contributions, yet 96 percent of the world’s wealth is held in physical assets such as real estate, excess or outdated business inventories, or personal possessions, including vehicles.

Moving to the Next Level

A car donation program is a great way for a nonprofit to expand its donor base and provide new ways to involve existing donors and volunteers. It is also an easy way for nonprofits to get their feet wet in asset donations of all kinds, learning the ropes of processing, tax laws, and asset management. Keep in mind the total costs associated with the process to insure your best chances for success before you start. That first car may be an ugly station wagon, but could lead to further success down the road.

By the way, about my first car: my mother came to my aid. “Maybe a high school boy might feel a little uncomfortable driving a wagon,” she said. My dad assured my social status the second time around; the next car he found was a sporty green MGB convertible, just in time for my senior year.

Eric is a site director for Hillcrest Transitional Housing, a 35-year-old Kansas City organization with a 90-day education and housing program for homeless families. For rejuvenation, he escapes the flatlands of Kansas and hikes in the Rockies. Here he is atop Mount Democrat outside of Breckenridge, Colorado, at 14,148 feet. Photo credit for billboard: telethon.

organization with a 90-day education and housing program for homeless families. For rejuvenation, he escapes the flatlands of Kansas and hikes in the Rockies. Here he is atop Mount Democrat outside of Breckenridge, Colorado, at 14,148 feet. Photo credit for billboard: telethon.

Have you ever given your vehicle to a donation program? Does your group have a program? Have you ever received a vehicle as a beneficiary through a nonprofit’s car donation program? Let all of us learn from your experience — post in Comments below!

You might also like:

- Grant Writing Isn’t Overhead — It’s Infrastructure

- Moving Beyond Performance: Making DEI Actionable

- Re-Imagining Fundraising: How Funder Education and Systemic-Change Approaches are Changing the Game

- The Million-Dollar Question: What Could Your Nonprofit Do if Money Weren’t an Issue?

- Can You Hear Us Now? Using Feedback to Create Community-Centered Services

You made it to the end! Please share this article!

Let’s help other nonprofit leaders succeed! Consider sharing this article with your friends and colleagues via email or social media.

About the Author

Eric A. Hynes is a site director for Hillcrest Transitional Housing, a 35-year-old Kansas City organization with a 90-day education and housing program for homeless families. For rejuvenation, he escapes the flatlands of Kansas and hikes in the Rockies. Here he is atop Mount Democrat outside of Breckenridge, Colorado, at 14,148 feet. Photo credit for billboard: telethon.

Have you ever given your vehicle to a donation program? Does your group have a program? Have you ever received a vehicle as a beneficiary through a nonprofit’s car donation program? Let all of us learn from your experience — post in Comments below!

Articles on Blue Avocado do not provide legal representation or legal advice and should not be used as a substitute for advice or legal counsel. Blue Avocado provides space for the nonprofit sector to express new ideas. The opinions and views expressed in this article are solely those of the authors. They do not purport to reflect or imply the opinions or views of Blue Avocado, its publisher, or affiliated organizations. Blue Avocado, its publisher, and affiliated organizations are not liable for website visitors’ use of the content on Blue Avocado nor for visitors’ decisions about using the Blue Avocado website.

We have been running a car donation program for many years and have seen the impact due to the revisions in the tax code. We take all veicles and proces them for resale. We have a lot that we sell the vehicles on and if the once pristine vehicle is no longer running, we sell it to the local PIck-n-pull for enough to cover the towing costs plus a little. In the past year, with the economy in the tank, we have seen a tremendous drop in auto giving. The biggest month is December with the close of the tax year. We also have a dealers license that allows us to purchase used vehicles for our lot.

I woulds like to start a car donation program. I would like some information and instructions on developing a successful car donation program. I can be reached at citywhipsinc1964@yahoo.com

We rarely get an offer of a car donation, and when we did recently we went through one of the nonprofits that you hear advertised. It was disappointing on all fronts. By the time they sold it for a fraction of blue book (it was operational), subtracted their fees and percentage – since they are a nonprofit, the resulting donation to our agency was minimal. But, the worst thing was that the donor was disappointed and we were lucky we didn’t lose her support because of this. In the future, we’d recommend the donor sell the car and donate the sale price.

(Name withheld, please).

March 2, 2009

We have a great car donation program thanks to a local car dealer. They look at the car and decide if it is worth taking in as a donation. If it is, they fix it up and then call us and we bring a pre-screened client to receive the car. The donor gets a tax receipt from us with the blue book value of the car. Our dealer often suggests to their customers they should donate a car rather than try to trade it in and we can send anyone who calls us with a car to donate to the dealer. Our clients are homeless and low income folks who must be able to afford to register and insure the vehicle before we send them to pick it up. We are VERY fortuante to work with this wonderful dealer, who initially came to us with the idea.

I’m grateful to Eric for this contribution – and for walking us (or driving us) through the range of considerations a group should weigh before getting involved in car donations. I was most intrigued by Eric’s assertion that "Nonprofits spend nearly 90 percent of their time soliciting cash contributions, yet 96 percent of the world’s wealth is held in physical assets such as real estate, excess or outdated business inventories, or personal possessions, including vehicles." This seems to have implications for nonprofits that extend far beyond cars, but my sense is that community nonprofits haven’t really explored this issue. Have we? At any rate, I’m also grateful to Eric for educating this East Coaster on what a 14’er is!

We are a vehicle processing center and the information above is all very good and true. Many of the issues addressed in this article are issues we deal with every day. There is something to be said for doing it on your own (more control and more profit) but there are also pitfalls as he suggested, (getting charged negative fees, following up with salvage yards that don’t pay and not having the manpower to really make it work).

The benefit of using a reputable (I stress this) and established processing center is that they absorb the losses and they are experienced at trying to get the most for your donation. After all, when you pay a percentage (shouldn’t exceed 25 to 30%) the processing center has a direct stake in getting the most for the vehicle and they usually handle everything, including tax forms and filing.

We have all heard horror stories, but in the end, last year we turned over $720,000 to nonprofits with very little effort on their part. Yes, we have heard from upset donors who thought their 89 Volvo should have sold for $2,000 but, we have heard from donors whose vehicles sold for substantially more than they realized. All-in-all, in my experience, the benefits to charities and donors FAR outweigh the complaints. It is becoming a mainstream fund raising tool, like direct mail campaigns, auctions or thrift stores. Millions of cars are being donated each year, why not let donors know your organization offers this fund raising opportunity if there is no out-of pocket expenses to you to provide this?

Jacquie Elliott,

Center for Car Donations, Bend Oregon

Here’s some advice to consider before just blindly handing over the title to your car. If you are dealing with a car donation center, ask them how much of the actual sale price the charity will receive. The term "net sale price" means the actual sale price minus auction fees, selling fees, or other fees charged by the center. Always make a copy of your title. Know who you are giving your car to. You should either mail your title to the charity or hand it directly to the person towing your car after they give you a receipt. Never, just leave the title in the car! If you do, you may not get a receipt and therefore, will have no proof of your donation. If you live in a state where you are required to remove the license plates, make sure you do! You won’t be able to cancel your car insurance until you have either transferred the plates to another car or returned them to the Department of Motor Vehicles. Make sure you keep all the correspondence between you and the charity. If you don’t, when you go to do your taxes, you’ll find yourself calling around to the various charities to find out which one you donated your car to.

Karen Campese

President/CEO

Cars4Charities Car Donation Center

http://www.cars4charities.org

If anyone is still reading this thread . . . .

We are a very small all-volunteer organization, and have been offered a car for donation. One of our board members (thank goodness for retirees) will handle the sale and paperwork. My question: except in certain situations that do not apply for us, the CA DMV requires cars to be smogged within 90 days before a transfer occurs, with the burden on the donor to obtain the smog certificate. I keep seeing that middle-man type car donation agencies do NOT require a smog certificate. It appears they have found some way to get around the requirement, but I haven’t found how.

Can anyone advise? We’d love to avoid having our donor smog the car.

Thanks!

Jacquie & Karen — thank you for your insights and further cautions for how nonprofits should go about assessing car donation centers and making sure they are best serving their donors. I am hoping someone from California can help with the smog question; that’s not something we deal with much in Missouri thankfully.

I’d also be interested to hear from readers how the Cash for Clunkers program affected (or didn’t) the number and quality of cars being donated. I know that I was saddened (though I understood the reasoning) that so many usable cars were being scrapped that could have helped families in need (not to mention nonprofits).

In the current economic environment, it may be more important than ever for nonprofit organizations to spend more creative brainstorming with donors on how to leverage their non-cash assets to continue the work of their favorite cause.

Eric Haynes

Hillcrest Transitional Housing

Kansas City

A bit surprised it seems to simple and yet useful.

Hi there, this article has great information. The CAC Education Center works with intellectually disabled children and families. We don’t have a vehicle donation program, but are thinking about starting one. I”d like more information about the scams that are out there, and steps w my organization can take to avoid becoming a victim of a scam. Thank you.

After research we were unable to come up with a resource. Suggestion would be to contact the Better Business Bureau to see if they can provide any guidance.

This post made an excellent point that when looking to start on a car donation drive, it is important that we ensure that everyone involved is both licensed and experienced. It makes sense as in doing so, it ensures that we are hirign the right people. I will definitely keep this information in mind for future references.

http://donateyourcardrive.org/

This is all great information, not sure if anyone is still reading this thread. I would like to know how the towing process works. How are the nonprofits able to afford the towing fee to pick up cars anywhere in the US. Our organization would like to start a car, equipment, speciality vehicle, land and real estate donation program and could really use some helpful back office information. I can be reached at ssazaz@zohomail.com

How can I start my own car donation business to receive donated cars..