Point-Counterpoint: Should Nonprofits Be Allowed to Support Political Candidates?

Arguments for & against legislation that prohibits churches & other charitable organizations from direct or indirect political campaigning.

Too Much Influence or Not Enough?

After signaling his intentions to do so at the National Prayer Breakfast in February, on May 4, President Trump signed an executive order aimed at weakening the Johnson Amendment, an act that has received mixed reaction from the nonprofit world. Created in 1954 by then Senator Lyndon Johnson, the legislation prohibits churches and other charitable organizations from direct or indirect political campaigning.

Although Trump cannot single-handedly eliminate the amendment (that’s a job for Congress), his executive order takes on enforcement of the legislation in what he described as an attempt to make sure “people aren’t unfairly targeted for their beliefs.”

But this begs the question: what does the administration’s latest move mean for nonprofit organizations? Will chipping away at Johnson be net positive or negative? The answer isn’t so clear-cut. Here, two voices within the sector weigh in.

Vikki Spruill

President Trump’s recent executive order aimed at weakening parts of the Johnson Amendment has set our nation on a misguided and slippery slope. Removing the protections of the Johnson Amendment threatens decades of important charitable work done by nonprofits and foundations to benefit people and communities all across the country.

For more than six decades, the Johnson Amendment, named after then-Senator Lyndon B. Johnson and signed into law by President Eisenhower, has kept nonprofit, tax-deductible foundations and charitable organizations out of electoral politics. This has enabled these organizations to occupy a unique and essential space in our society, channeling the tax-deductible generosity of private citizens and organizations towards the causes and issues that resonate with their passions and experiences and help solve some of society’s greatest challenges.

Unfortunately, recent moves by the White House appear to be the first steps in efforts to blur an important distinction that exists between tax-exempt institutions and political organizations. President Trump directed the Department of Treasury and other agencies to not enforce the Johnson Amendment provisions on religious groups. While the White House attempted to frame this as a religious freedom issue, the fact is that the Johnson Amendment applies much more broadly to 1.2 million charitable organizations registered in the United States as well, including foundations.

Essentially, this opens the door for nonprofit organizations to endorse candidates and accept unlimited, anonymous, tax-deductible political donations completely unchecked.

For the Council on Foundations, the executive order raises serious concerns about future White House or congressional action that would leave the philanthropic sector vulnerable to abuse and corruption. For instance, because of the tax-deductible benefits of donating to nonprofits and philanthropic organizations, political donors could be incentivized to switch from giving money to political action committees, which are required to identify their donors, and instead give to nonprofits, which are not required to identify donors. These sorts of loopholes would have far-reaching effects on charities, foundations, and nonprofits all across the country and seriously compromise their independence.

This simply cannot happen.

Recently, the Council on Foundations joined forces with National Council of Nonprofits, Independent Sector, the Forum of Regional Associations of Grantmakers, and others to garner more than 4,500 signatures from foundations and nonprofit organizations of all sizes urging Congress to join “in opposing efforts to weaken and/or repeal the current law that for six decades has successfully protected the integrity and effectiveness of charitable nonprofits and foundations by keeping them apart from partisan politics.”

We will continue to be vocal in the coming months about the need to leave the Johnson Amendment in place and leave nonprofits out of electoral politics. The years of public trust that the philanthropic and charitable sectors have earned simply cannot afford to be diminished or tainted by partisan labels or influence. The nonprofit sector, which includes our faith-based organizations, foundations, and charities, needs to maintain its independence as it continues to provide the social capital to lift up the disadvantaged and strengthen communities.

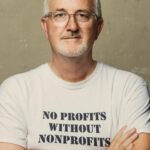

Robert Egger

The Johnson Amendment was never intended to protect nonprofits from politics; it was designed to protect politics from nonprofits. Weakening it is no tragedy.

In 1954, citing no evidence of previous scandal or abuse, senate Minority Leader Lyndon Johnson introduced this bill, without hearings or recorded testimony, allegedly to silence nonprofits supporting a rival.

I suggest that this legend hides a more corrupt intent. It was targeting the organizing ability of black churches at a time when the demand for voting rights was moving forward.

As any biography will attest, Johnson rarely made a move that wasn’t based on astute political calculation. He introduced this amendment a scant 45 days after the landmark Brown v. the Board of Education overturned the Plessy v. Ferguson decision that had codified segregation for 58 years.

Brought by Oliver Brown, an African-American Pastor in Topeka, and argued by the National Association for the Advancement of Colored People (NAACP), this alliance of local and national nonprofits represented a political organizing union that Johnson and southern Democrats knew would hasten the end of racist voting suppression.

I believe that the Johnson Amendment was meant to thwart, or at least slow this process.

And while some will point to Johnson’s later advocacy for civil rights, I would suggest that the same political calculus for maintaining power might account, in part, for his support.

But racial justice wasn’t the only issue challenging the status quo.

Women constituted 14 percent of the workforce in 1954. By the 1980s, when Congress again affirmed the demarcation, women had increased to 48 percent of the workforce, and represented seven out of 10 of the sector’s 10 million employees.

The ongoing efforts to keep nonprofits separated from the political process is steeped in sexism aimed at stopping these women-led businesses from organizing themselves, their clients, or their volunteers to challenge the authority of the male dominated business and political classes.

When you consider this possibility, the “protect the integrity” argument made in the recent letter signed by so many nonprofit leaders sounds strikingly similar to warnings made against women’s suffrage. In fact, in the 72 years between the Seneca Falls Convention and the passage of the 19th Amendment, advocates for suffrage did not spend as much time trying to convince men of their rights. It was other women they had to convince.

Like nonprofits today, women had been told they couldn’t for so long that they actually believed they shouldn’t.

I have said before: “There is no profit without nonprofits”. No town can prosper or attract investment without communities of faith, healthcare, education, arts and culture, or the many benefits nonprofits create and maintain. Yet we cannot support or endorse candidates that respect our role, or view us as partners in creating more vibrant communities.

Dr. King said, “There comes a time when silence is betrayal.” All evidence suggests that our silence has not protected our causes, clients, communities or us. Now should be the time when we own our voices, and our rights long denied, to be equal participants in democracy.

You might also like:

- Can You Hear Us Now? Using Feedback to Create Community-Centered Services

- The 3 ‘Rs’ of Equitable Community Engagement

- Four Ways to Remove a Board Member

- Treasurers of All-Volunteer Organizations: Eight Key Responsibilities

- An Easy-to-Use Accounting Procedures Manual Template

You made it to the end! Please share this article!

Let’s help other nonprofit leaders succeed! Consider sharing this article with your friends and colleagues via email or social media.

About the Author

Articles on Blue Avocado do not provide legal representation or legal advice and should not be used as a substitute for advice or legal counsel. Blue Avocado provides space for the nonprofit sector to express new ideas. The opinions and views expressed in this article are solely those of the authors. They do not purport to reflect or imply the opinions or views of Blue Avocado, its publisher, or affiliated organizations. Blue Avocado, its publisher, and affiliated organizations are not liable for website visitors’ use of the content on Blue Avocado nor for visitors’ decisions about using the Blue Avocado website.

I am very glad to see someone of Robert Egger's stature make an argument for

getting rid of the Johnson Amendment. I agree it was passed in a cold

political calculation by Johnson to thwart his enemies and not for any lofty

principle that nonprofits stay above the fray. I also think the loops that

nonprofits have to jump through to lobby on behalf of our clients and

communities are ridiculous. Who better than a nonprofit to testify about

the impact of a proposed law? We are not peddling a product or service for

financial gain but to improve the lives of those we serve. Our opinions are

needed to counter the overwhelming influence of most for-profit lobbyists.

Should you listen to a representative of the pharmacy industry over a local

health clinic doctor? An investment industry representative over a consumer

advocate? A for-profit housing backer over a tenant rights representative?

For too long our opinions have been stifled, with hurdles that make most

nonprofits reluctant to speak out. While in our current state of high

partisan conflict it might be tempting to want to stay above the fray it is

more critical than ever to be sure our voices are heard.

American United for the Separation of Church and State (a long-standing highly-respected legal organization) recently posted:

“We’ve seen the unfortunate influence [on the White House] of the Religious Right on a host of other issues, including efforts to repeal or weaken the Johnson Amendment (which protects the integrity of houses of worship by prohibiting them from intervening in partisan elections), attempts to undermine birth control access and the Justice Department’s recent decision to side with a Colorado bakery that wants a constitutional right to discriminate against members of the LGBTQ community.”

The issue of repealing the Johnson Amendment has been brought about by the religious right/tea-party, and is not the result of some well-meaning high school civics class homework assignment. I thought that was common knowledge, but maybe not, so I’m sharing this.

I wanted to update readers on how the possible repeal of the Johnson Amendment is proceeding in Congress. Very Very bad to start merging church with state, which is what this issue is about. It’s really quite simple to understand, so please call your U. S. Senator today.

So, here’s the deal, as recently summarized by the long-standing and well-regarded (and fun!) Freedom from Religion Foundation: edited for length

“Late Thursday afternoon [9/14/17], the House passed a megabus budget package — the Fiscal Year 2018 Financial Services and General Government Appropriations bill. Included in the budget was a provision, Section 116, to prohibit the Internal Revenue Service from enforcing the Johnson Amendment as it applies to churches.

“The Johnson Amendment currently applies equally to all 501(c)(3) nonprofits, not just churches, prohibiting them from using tax deductible donations for political purposes. But Provision 116 would place only churches, pastors and priests above the law.

“If churches are allowed to politick from the pulpit while retaining tax exemption, they will become unregulated super PACs. Congress will create a new category of “dark money.” That’s because churches are financial black holes, which, unlike every other 501(c)(3) are not required to report annual financial returns [990] to the IRS.”