Does Your Nonprofit Receive Donations of Services, Supplies or Equipment? Changes are Coming!

A new accounting standard will bring clarity and consistency to how in-kind contributions of nonfinancial assets are reported for nonprofits.

Changes to How Nonprofit Organizations Report In-kind Contributions of Nonfinancial Assets

It is common for nonprofits to receive donations and contributions of nonfinancial assets, more commonly known as in-kind contributions. Typical examples of in-kind contributions a nonprofit may receive include but are not limited to:

- Pro bono legal & professional services

- Below-market rent payments

- Donated supplies & equipment

- Donated buildings & land

- Donated housing

Although nonprofits have been required to report the value of in-kind contributions in their financial statements for some time, there has not been consistency in the practice of this reporting. However, a new accounting standard, set to take effect on June 30, 2022, will bring clarity and consistency to how in-kind contributions of nonfinancial assets are reported.

FASB Accounting Standards Update (ASU) No. 2020-07, Presentation and Disclosures by Not-for-Profit Entities for Contributed Nonfinancial Assets, requires nonprofits to present contributed nonfinancial assets as separate line items in the statement activities, disaggregated by category of the nonfinancial asset received. Nonprofits are also required to provide additional disclosures about contributions of nonfinancial assets. This new standard is effective for financial statements with June 30, 2022 year ends and after.

But don’t worry—these are not drastic changes.

This new accounting standard should not result in wholesale changes to how a nonprofit calculates the value of the receipt of nonfinancial assets, since nonprofits have already been required to disclose such calculations. Instead, the new standard simply brings consistency to how a nonprofit reports and discloses these types of transactions in their financial statements, as well as provides the readers and users of a nonprofit’s financial statements with more information for how a nonprofit values and utilizes the receipt of nonfinancial assets.

Key Provisions and Requirements of the Update

- To reiterate: the value of in-kind contributions must be presented as separate lines in the statement of activities, disaggregated by category of the nonfinancial asset received.

- Within the financial statements, footnotes and disclosures must include the following for each category of nonfinancial asset received:

- Qualitative information about whether contributed nonfinancial assets were either monetized (sold for cash) or utilized (used in the nonprofit’s operations) during the reporting period. If utilized, a description of the programs or other activities in which those assets were used must be disclosed.

- The nonprofit’s policy (if any) about monetizing (selling for cash) rather than utilizing (using donated equipment for nonprofit operations) contributed nonfinancial assets

- A description of any donor-imposed restrictions associated with the contributed nonfinancial assets

- A description of the valuation techniques and inputs used to calculate the value of the nonfinancial assets received, including the principal market (or most advantageous market) used to arrive at a fair value measurement

- A nonprofit that receives contributed services must describe both:

- The programs or activities for which those services were used, including the nature and extent of contributed services received for the period

- The amount recognized as revenues for the period

- Entities are encouraged to disclose the fair value of contributed services received but not recognized as revenues if that is practicable. The nature and extent of contributed services received can be described by nonmonetary information (i.e., the number and trends of donated hours received or service outputs provided by volunteer efforts) or other monetary information (i.e. the dollar amount of contributions raised by volunteers).

Note: disclosure of contributed services is required, regardless of whether the services received are recognized as revenue in the financial statements.

This might sound confusing, but you can refer to the following examples for a more detailed picture of what these notations might look like. Keep in mind these examples are not all-encompassing and your organization may have unique situations not covered by the following examples.

Example 1

Note X – Contributed Nonfinancial Assets

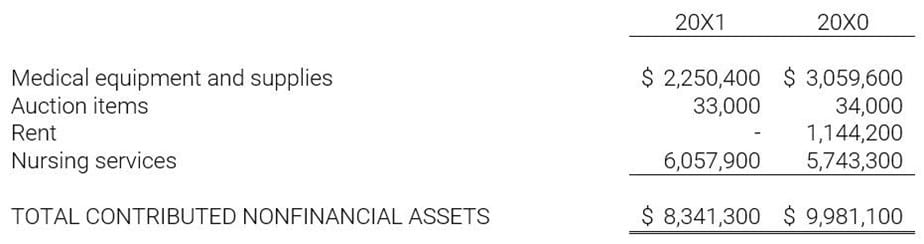

The organization received the following contributions of nonfinancial assets for the year ending June 30:

Medical equipment and supplies—Contributed medical equipment and supplies received by the organization are recorded as in-kind contribution revenue with a corresponding increase to inventory. The organization utilized three inventory valuation methods during the year ended June 30, 20X1 and 20X0. These methods include (1) current price located on a publicly available website if the inventory item is a match for the website item when donated; (2) percentage of the price located on a publicly available website if the item donated has been used but the item located online is new; (3) the current average price located on a publicly available website for similar items if a group of items are donated and the items range in price depending on model, size, etc. Contributed medical equipment and supplies were utilized in the organization’s partial hospitalization program.

Auction items—The organization receives items to be sold at its annual auction, and it is the organization’s policy to attempt to sell any unsold auction items on various commercial websites used for such purposes. Contributed auction items are valued at the gross selling price received.

Rent—The organization entered into a lease agreement for office space, for which the rental payments stated in the agreement are less than the amount that would be charged for similar space that is rented under similar terms. Using publicly available commercial real estate rental listings, the organization estimates the rental payments to be half of market price. The amount of contributed rent over the remaining lease term is reported as contributions receivable in the accompanying statements of financial position, and the related rent expense is recorded straight line over the life of the lease in the accompanying statements of activities. The contributed office space is used for both program and supporting services and is allocated based upon square footage used by each program and supporting service.

Nursing services—Contributed services are recognized as in-kind revenues at their estimated fair value if they create or enhance nonfinancial assets or they require specialized skills that would need to be purchased if they were not donated. The organization receives contributed nursing services that are reported using current rates for similar nursing services. The organization also receives a significant amount of donated services from unpaid volunteers who assist in fundraising and special projects. No amounts have been recognized in the statements of activities for these fundraising and special projects services because the criteria for recognition have not been satisfied. Contributed nursing services were utilized in the organization’s partial hospitalization program.

Example 2

Note X – Donated Services and Assets

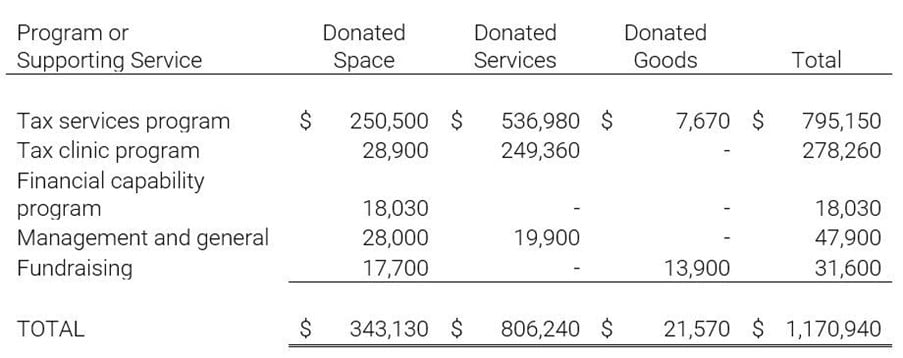

The organization receives significant in-kind contributions of time and pro bono services from members of the community and volunteers related to program operations, special events, and fundraising campaigns. Donated services are recognized as contributions if the services (a) create or enhance nonfinancial assets or (b) require specialized skills, are performed by people with those skills, and would otherwise be purchased by the organization. The organization recognizes in-kind contribution revenue and a corresponding expense in an amount approximating the estimated fair value at the time of the donation.

During fiscal year 20X0, the organization received donated services for tax preparation, legal consultation, and other consulting services. The organization also received contributions of the use of facilities and donated goods.

All donated services and assets were utilized by the organization’s programs and supporting services. There were no donor-imposed restrictions associated with the donated services and assets.

Donated space is valued at the fair value of similar properties available in commercial real estate listings. Donated program services are valued using the most recent Bureau of Labor Statistics’ average hourly wage for tax preparers (tax services and tax clinic) and credit counselors (financial capability program) in the organization’s metropolitan area. Donated legal services included in management and general are valued at the standard hourly rates charged for those services. Donated goods are valued at the wholesale prices that would be received for selling similar products.

Example 3

Note X – In-Kind Contributions

The organization receives donated services from a variety of unpaid volunteers who assist the organization in the operation of the transportation and nutritional programs. Donated services are recognized as contributions if the services (a) create or enhance nonfinancial assets or (b) require specialized skills, are performed by people with those skills, and would otherwise be purchased by the organization. Services valued at approximately $132,000 and $93,000 have not been recognized in the accompanying statements of activities for the years ended June 30, 20X1 and June 30, 20X0, respectively, as they do not meet the requirements for recognition (i.e. they do not require specialized skills).

The organization also receives the use of donated facilities for its program operations and supporting services. The organization recognizes in-kind contribution revenue and a corresponding expense in an amount approximating the estimated fair value at the time of the donation. Fair value is estimated using the average price per square foot of rental listings in the organization’s service area. The total amount recognized for donated facilities is approximately $187,000 for each of the years ended June 30, 20X1 and June 30, 20X0, and is allocated among program and supporting services based upon the square footage occupied.

You might also like:

- Do Nonprofits Pay Taxes? Do Nonprofit Employees Pay Taxes?

- Your IRS Form 990 Questions Answered

- Treasurers of All-Volunteer Organizations: Eight Key Responsibilities

- An Easy-to-Use Accounting Procedures Manual Template

- A Guide for Private Foundations: Tax Exemption and 990-PF Filing Requirements

You made it to the end! Please share this article!

Let’s help other nonprofit leaders succeed! Consider sharing this article with your friends and colleagues via email or social media.

About the Author

Bradley Bartells is a Partner with MUN CPAs in Sacramento. He has more than 24 years of public accounting experience, having spent a significant portion of his career providing audit services to nonprofit organizations and employee benefit plans. Bradley has a passion for serving nonprofits and supporting the organization’s mission and purpose. Bradley is a former Board member and Treasurer of the Inderkum HS Athletic Booster Club and former Treasurer of Fairytale Town in Sacramento.

Articles on Blue Avocado do not provide legal representation or legal advice and should not be used as a substitute for advice or legal counsel. Blue Avocado provides space for the nonprofit sector to express new ideas. The opinions and views expressed in this article are solely those of the authors. They do not purport to reflect or imply the opinions or views of Blue Avocado, its publisher, or affiliated organizations. Blue Avocado, its publisher, and affiliated organizations are not liable for website visitors’ use of the content on Blue Avocado nor for visitors’ decisions about using the Blue Avocado website.