Accounting

An Easy-to-Use Accounting Procedures Manual Template

Accounting Procedures Manual Template in Word. Download the Word document, and everything you need to fill in is in red.

A Beginner’s Guide to Filing a Form 990 for Your Nonprofit Organization

For nonprofit organizations, filing a Form 990 can be overwhelming and confusing, especially if it’s your first time. In this article, we will discuss everything you need to know about filing a Form 990, including six steps to take before, during, and after transmitting your form to the IRS.

How Nonprofits Can Benefit from Embracing ESG Practices

By expanding ESG efforts and communicating them effectively, nonprofits can engage new audiences and achieve greater impact. This article discusses how nonprofits can document and communicate their ESG impact and provides five steps to get started.

Does Your Nonprofit Receive Donations of Services, Supplies or Equipment? Changes are Coming!

A new accounting standard will bring clarity and consistency to how in-kind contributions of nonfinancial assets are reported for nonprofits.

Alleviate Accounting Systems & Staff Training Chokepoints to Power Nonprofit Missions: Part 2

A case on how one Oregon nonprofit did it. Part 2 of 2.

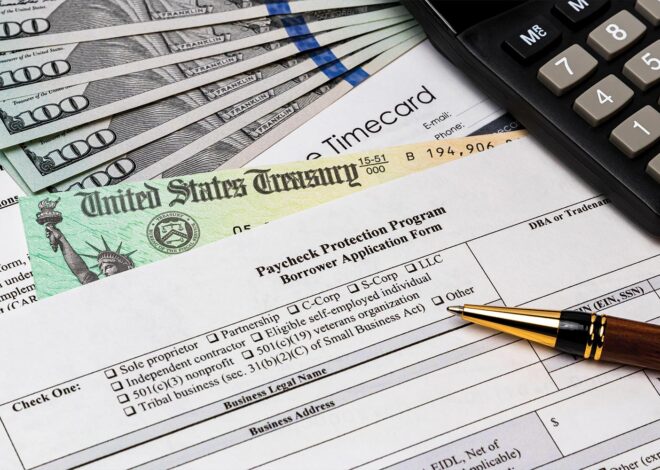

The Employee Retention Credit: What Nonprofits Need to Know

Originally enacted as part of the CARES Act in March 2020, and subsequently voted into law last December, the Employee Retention Credit (ERC) may now be claimed by eligible employers — and that includes tax-exempt nonprofit organizations — that previously […]

Alleviate Accounting Systems & Staff Training Chokepoints to Power Nonprofit Missions: Part 1

A case on how one Oregon nonprofit did it. Part 1 of 2.

Running Your Nonprofit’s Accounting Department During COVID-19 and After

A professional accountant discusses how to make your nonprofit’s accounting more virtual.

A Primer on Nonprofit Contributions and Revenue from Contracts with Customers

Revenue from contracts with customers (ASU 2014-09) will impact your nonprofit, depending on the nature of your revenue and support.

IRS Tax Form 990 [Deadline Extended]: How to File It, When to File It, and Why It’s So Important

For nonprofits, filing tax form 990 is key to retaining tax-exempt status. Here are the key features of tax form 990 and how to file it.

![IRS Tax Form 990 [Deadline Extended]: How to File It, When to File It, and Why It’s So Important](https://blueavocado.org/wp-content/uploads/2020/05/flag-form-990-660x470.jpg)