The Ultimate Guide to Nonprofit Fundraising in 2026

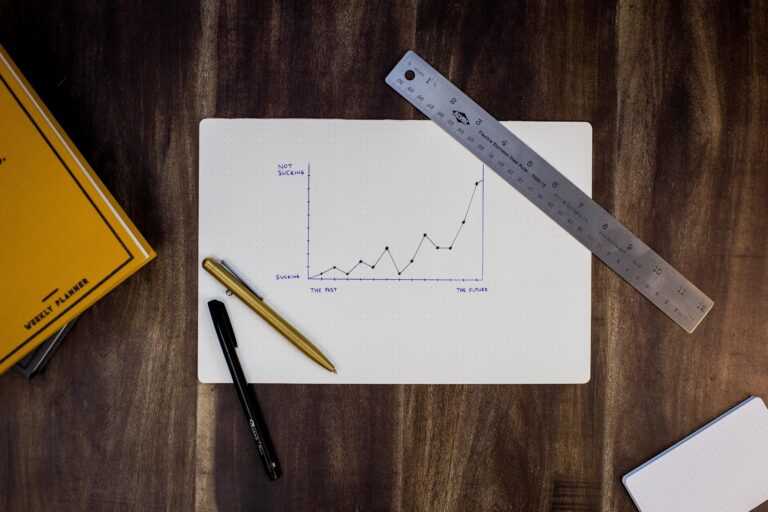

Fundraising Fuels Your Nonprofit’s Mission

Like it or not (probably not), fundraising represents an integral aspect of the nonprofit world.

In fact, it is often listed second only to leadership in the executive director’s job description, frequently appearing before program management.

As anyone who has tried to implement nonprofit programming will tell you: It’s as effective as its funding. Without consistent funding, a great idea for a community program stays just that — a great idea.

Put another way, funding is how nonprofits turn great ideas into reality; it is the mechanism by which nonprofits can improve the conditions of the communities they serve.

And here at Blue Avocado, we like things that are practical. In fact, that’s probably why you come here, too.

So, we figured what would be the most practical, then, would be to break down all the best practices in terms of fundraising and put it into this handy guide that you could sort through at your leisure.

In this guide, you’ll learn about different sources of funding, as well as some best practices and innovative approaches associated with each source.

Because, you know, people who work at nonprofits tend to have a lot of time on their hands — and absolutely aren’t hurriedly reading through this as they wolf down their lunch or await their next meeting.

We want to make it easier for nonprofits to access the funding they need to accomplish their goals and better serve their communities.

It is our hope that you’ll come away from this guide with a few new things to try out as well as a more solid understanding of the nonprofit fundraising sources you’re already pursuing.

And because the most valuable information is given freely, we’d like to encourage you all to share this — with your staff, your board, and with other nonprofits.

Table of contents

- Fundraising Fuels Your Nonprofit’s Mission

- Five Sources of Funding for Nonprofits

- FAQs: Common Concerns about Nonprofit Funding, Fundraising, and other Fiscal Issues

What Do Nonprofits Need Funding For, Anyway?

If you work in a nonprofit, this might seem self-explanatory.

However, it is still important to articulate these so that we have a common language we’re all speaking from — and so we know how to remind funders what it takes to implement programming.

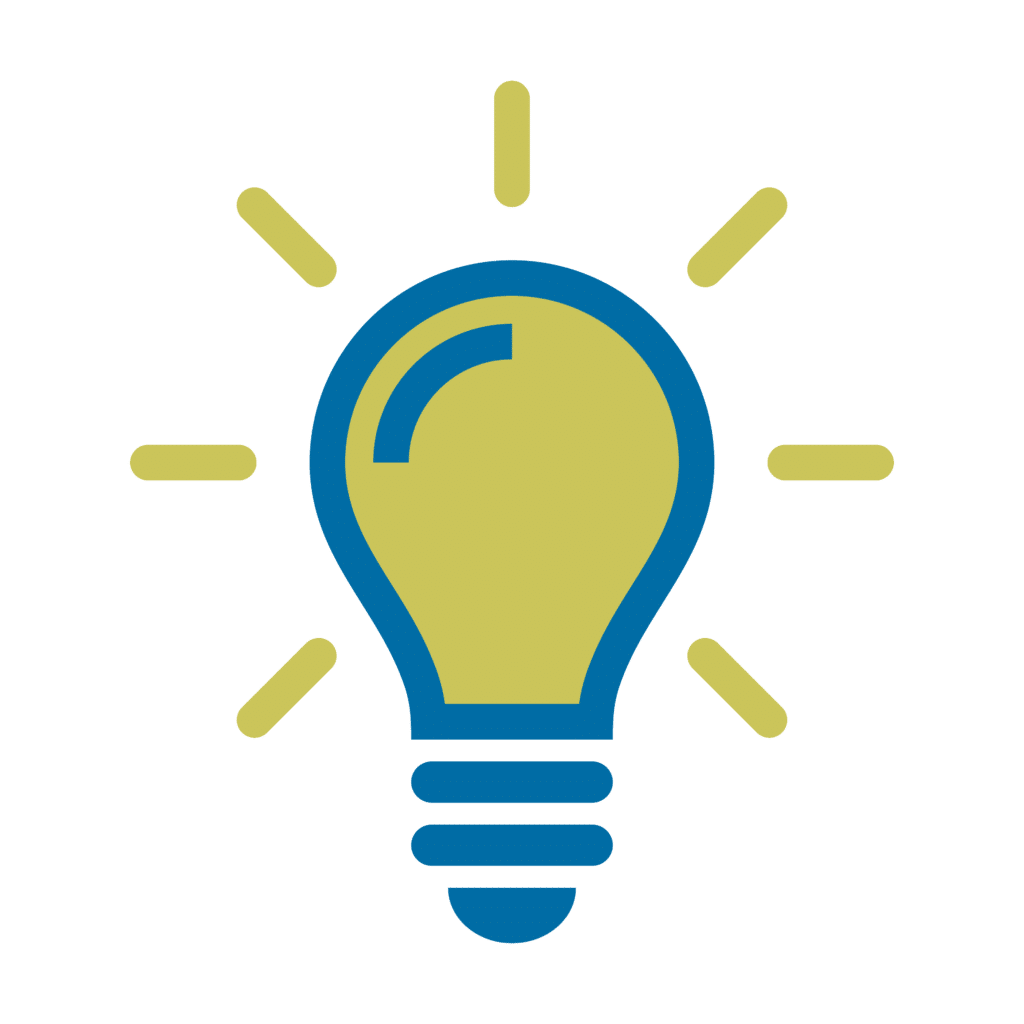

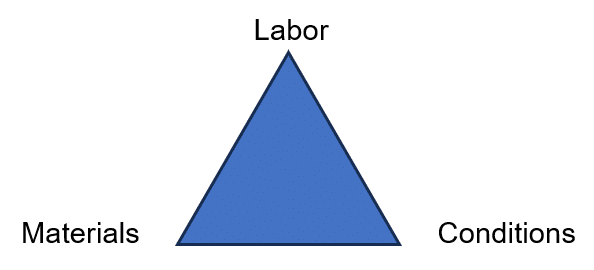

At the most basic levels, nonprofits need funding for three things: Human labor, the materials that labor works with, and the conditions within which that labor is accomplished.

Labor, materials, and conditions — these constitute the triangle from which nonprofit programming is constructed. Without one, the strength of the entire structure is compromised.

However, knowledge about this goes both ways, especially regarding the pesky conditions of labor, what is often also referred to as “overhead.”

In fact, understanding the way these three areas uphold each other is integral to funding nonprofit programming itself. This is one reason why funders must discuss overhead, both with each other and with the nonprofits they fund.

Another reason for this clarification is nonprofit’s proximity to the for-profit world. That is, nonprofit funders and board members both often come from the for-profit world, where they think they understand the difficulties nonprofits face in terms of funding.

However, nonprofits tend to operate in the shadow universe of for-profits, where common-sense operations are often turned on their head. Put another way: The rules that apply to businesses in terms of good practices cannot necessarily be applied to nonprofits.

So even if the things that need funding — labor, materials, and conditions — seem similar to what is experienced in the for-profit world, they might not manifest the same way.

And, perhaps more importantly, the best practices for nonprofit fundraising might be wildly different from what for-profits would do to garner investments, government contracts, or other funding sources.

This is to say that part of what we want to do with this guide is to give a nonprofit-centric alternative to the many books, webpages, etc. dedicated to savvy business strategy.

However, a note of caution remains. Research has shown that most fundraising advice is not geared towards nonprofits of color. At Blue Avocado, we do things a little differently. After all, we publish advice from the experts themselves — you, the people in the sector who have actually implemented the strategies suggested here.

But even though we think this grassroots knowledge-sharing system represents the best praxis itself, we’d still advise you to take the advice given here with a grain of salt — what works for one nonprofit may not work at all for another. Part of what we want to do is to help nonprofits work against such systemic inequality.

Make sure you’re checking in with yourselves and your stakeholders before revamping your whole nonprofit fundraising strategy.

And check out the “Ways to Pursue Funding Equity” subsection below for strategies nonprofits and funders alike can implement in pursuit of funding equity. After all, equity only works if we’re all on board — and even then, it’s still a work in progress.

Developing A Revenue Strategy for Your Nonprofit

Before we get into the details of all the different potential sources of nonprofit fundraising (and any advice therein), we need to talk more generally about revenue strategy.

Here, your revenue strategy differs slightly from what some nonprofits would consider as their main source of funding: Their fundraising strategy, which only counts contributed income.

Simply put: Revenue strategy is about all possible streams of funding — both earned and contributed; it’s also sometimes referred to as your nonprofit’s capital structure.

So, one of the first things to recognize is that your nonprofit needs a revenue strategy. That is, part of the executive director’s job is to organize the nonprofit’s revenue strategy, deciding what streams of funding to pursue and when.

Learn more on how to choose your revenue strategy.

But hold up: Your nonprofit (most likely) isn’t just you! Let go of some of the responsibility (and stress) of nonprofit finances by organizing your board to support a revenue strategy.

For example, one of the ways your board can help is by using their expertise to analyze your budget. With this budgetary analysis, you can choose the best revenue strategy for your nonprofit.

When you’re talking to your board about your revenue strategy, however, you might realize that it’s a bigger job than even all of you together can handle. In fact, unless you are a micro-organization, chances are you might have to invest in some variety of development personnel.

And again, this is a necessary expense — after all, your programming can’t run if it isn’t funded!

However, there are appropriate steps you can take to build your development team. Check out this fun, absolutely fictional, account of what such a conversation might look like, courtesy of a development consultant.

Around these conversations, it is crucial to keep one piece of advice in mind: Diversification is key — relying on only one source can be potentially hazardous for a nonprofit.

Consider, for example, whether your nonprofit’s finances are solvent enough to withstand an economic recession: Do you rely too heavily on the goodwill (and financial security) of donors? Are you completely dependent upon the interest earned from a stock-market-based endowment?

Either of these situations could spell potential trouble for your organization, given the right — or perhaps the wrong — circumstances.

Of course, there is only so much you can do to mitigate potential financial instability for your organization. You shouldn’t keep yourself up at night anxiously checking market prices or harassing potential donors. In fact, times of financial instability can be a good time to double-check the sustainability of your revenue strategy.

For example, the financial instability of the COVID-19 pandemic caused many nonprofits to rethink their cash reserve policy, with many deciding to spend less on programming in the face of future economic uncertainty.

But even if you use this time to rethink your nonprofit revenue strategy, maintaining a diverse revenue strategy should still act as the star guiding for your nonprofit through these financial storms.

And this diversification must extend beyond mere different sources of funding. A diverse revenue strategy means that the funding itself needs to be able to support your diversity of expenses — including the labor, materials, and conditions. Without one, your nonprofit programming crumbles.

So, now that we’re all on the same page in terms of the need for diversification, let’s take a look at the different potential sources of funding. After all, it’s hard to choose if you don’t know what’s on the menu!

Five Sources of Funding for Nonprofits

Jump links to each:

Don’t have time to read through these sections? Here’s a quick overview of many different types of nonprofit funding sources.

1. Donors: Find New Funders for Your Nonprofit (and Keep Ones You Have)

Donors are an essential source of needed funds for nonprofits — and there are many different ways to cultivate that support.

There’s a reason why donors appear first in this list of potential sources of nonprofit fundraising: Much of an executive director’s job (sometimes to their great disappointment) concerns schmoozing prospective or current major donors.

And, at first glance, this time management might make sense: According to a 2022 report, donations from individual donors (instead of foundations or corporations) constitute the vast majority of charitable gifts.

However, research suggests that this number is skewed by individuals’ propensity to donate to religious organizations, hospitals, universities, and churches. For other nonprofits (aka most of you), the revenue from individual donors might be closer to 13%.

You know better than anyone else what percentage of your nonprofit revenue strategy donors constitute.

But even if it’s an admittedly negligible percentage, this might be an area where your revenue strategy can grow — or you might even be able to implement some of the practical advice garnered here in another stream of your nonprofit revenue strategy.

The Possibilities, as Always, are Endless!

However, like any other source of funding, not all donor contributions are the same. At their most basic, contributions can be restricted, conditional, neither, or both — and all come with their own rules.

But, before you panic about these nuances, check out FAQ #5 for a breakdown of these terms and the rules associated with them.

Beyond fiscal donations, donors can also contribute non-cash items, which are referred to as “in-kind contributions.” These might be materials that the nonprofit can use or can resell for liquid revenue.

For more on in-kind solicitations, check out the following resources:

Whether you decide to solicit for in-kind or cash contributions, two things are crucial to keep in mind:

- First, you need to make sure all charitable solicitations are legally compliant. That is, remember that most states regulate charitable solicitation — so check your state and local laws about what you need to register in regards to your fundraising.

- Secondly, it is illegal to require employees to volunteer or donate. This means that nonprofits cannot require their employees to donate anything — time, money, or otherwise — to the organization. Any nonprofit who does this is in violation of the federal Fair Labor Standards Act.

Data

Apart from making sure that your nonprofit fundraising campaigns are legally compliant, you should also absolutely be keeping track of your donors — at the very least, monitoring who is giving to your organization, when, and how much.

This is not necessarily so you can publish a donor list, as there’s actually evidence to show donor lists might be antiquated wastes of time and money. Instead, you’ll want to monitor your donor database to make sure that you can notice your own trends in giving (and attrition), as these might differ from the latest charitable giving statistics.

Similarly, you also need to pay attention to who has given recently — no one appreciates being asked for another donation when they’ve just given you one.

It probably shouldn’t be a surprise that data-driven, targeted donor campaigns tend to be more effective than throwing spaghetti at a wall and seeing what sticks. However, this also means that you have to make sure you have the right data system to collect your donor statistics.

Knowing Which Statistics to Track is Essential

But all the data in the world won’t make a difference if you don’t effectively implement it. So, your donor engagement data strategy must include methods for data implementation. For some examples of what this might look like, check out these helpful tips.

Lastly, when you’re collecting donor statistics, focus less on quantitative measurements and more on the qualitative.

Engage with your donors. Ask for their opinions and truly listen to what they say. You might be surprised at the result!

And Remember: Data Goes Both Ways — Donors are Looking at You, Too.

Often they’ll use charity raters — some of which are more reliable than others (check out this review of different charity raters) — but that doesn’t mean you can’t use these to your advantage! In fact, you might consider managing your rating as a method to attract more donors.

New Donors

Now, let’s take a look at the most prized and elusive of donor categories: New donors.

Getting new donors (and, by extension, securing a major gift) is all about building donor relationships. You want to approach donors as people by evangelizing about the mission and outcomes of your nonprofit, not selling.

In this approach, you might also try to incorporate what is known as the “Hand-Head-Heart” method of donor engagement. You can even use the skills of public speaking to pitch your nonprofit to prospective donors!

For more resources on new donor engagement, check out this interview with a major gifts officer. And read about some common myths about major gifts.

But wait! New donor engagement, like all fundraising, shouldn’t be left up to the responsibility of the executive director — or even your development team, if you have one.

Rather, your board is a great resource, and you should have your board members help recruit prospective donors. But, be sure you don’t leave your board members out to dry — make sure they know how to cultivate friendly relationships with the people who support your nonprofit.

Of course, not all nonprofits are the same, which means these tactics might not work for every organization. You might even consider yourself an affinity organization, which means the way you fundraise won’t be the same as how others do it.

Confusing? You might be wondering exactly how you’re going to pull all of this off — especially if you’re a small nonprofit.

To save you the trouble, here’s an overview of how to cultivate major donors with a small staff.

Looking to get into more specifics? You might also use the digital tools of online fundraising stretch limited resources — and even register with the Combined Federal Campaign.

Again, it’s really all about finding a strategy of donor engagement that works for you — and that you can get your people on board with as well!

And, just like nonprofits, no two donors are the same. That means the ways they give and the reasons behind why they give aren’t the same, either (check out this donor’s perspective on charitable motivations).

Again, this is one of the reasons you should be tracking your donor data: You need to know who is giving and when, so you know which new donors you might yet target.

For example, there’s been a big push lately to engage younger donors, including extensive research in age-based trends in giving.

Crowdfunding/Peer-to-Peer Fundraising Ideas for Nonprofits

One of the ways you might connect with younger donors is by engaging college students for crowdfunding.

Here, you might start with a new donor or begin with a current donor, but the goal is still to build a larger new donor base, using people’s connections to create a donor network.

Another form of crowdfunding is peer-to-peer (P2P) fundraising, where (typically older) donors pledge “x” amount of money every year for “y” years.

Once again, you start by asking a new/current donor to reach out to 10 friends, who then each ask 10 of their friends to donate, and so on.

With crowdfunding, donors are usually simply promoting the organization on social media and identifying that they’ve donated — whereas, with P2P fundraising, the donors are asking specific people to make donations as well.

Discover more P2P fundraising tips and tricks.

This is why general crowdfunding tends to work for younger donors, while more targeted P2P fundraisers require a steadier stream of income, so to speak.

Whatever nonprofit fundraising strategy you choose, remember to track who is giving you money and where it is coming from.

If you decide to deploy a P2P or crowdfunding venture, for example, you’ll want to know how effective it was — especially if there’s a chance you might use it again in the future.

Current Donors

Of course, all your effort concerning donor engagement can’t just be focused on your flashy new donors — you’ll need to show your loyal donors some love, too! After all, it takes much more energy to cultivate a new relationship than it does to maintain an existing one.

With this in mind, it is crucial that you maintain a strategy to improve donor retention, such as using your budgeting and/or reporting to engage donors.

Whatever strategy you pick, remember that continuous communication with donors — especially during times of uncertainty — is crucial to maintaining their loyalty.

Even if you lose donors for a time, don’t despair! There are still nonprofit fundraising strategies you can employ to win back lapsed donors.

Planned Giving Programs

If you’re a nonprofit who has developed a group of loyal donors, you might have heard of planned giving programs.

Despite the formal-sounding name, fear not! It simply means a gift that is planned — either during a donor’s lifetime or via their estate (also known as legacy gifts).

Implementing a planned giving program is easier than you might think, and soliciting legacy gifts doesn’t have to make you feel like an awkward vulture. In fact, here are some step-by-step instructions for asking donors to list your nonprofit as a recipient of their estate, courtesy of a legacy giving consultant.

Personal Campaigns

Sometimes, the best way to get people to donate to your nonprofit is by word-of-mouth (hey, that’s kind of how Blue Avocado operates, fancy that!). This means enlisting people in personal campaigns in order to expand your donor network.

Some personal cash-based campaigns might include Facebook fundraisers or “Biggest Loser” competitions (like the one put on by this executive director), while in-kind personal campaigns might focus on donating your car (the right way).

Whatever the campaign, you usually need a charismatic individual (like a board member or ED) behind it, as well as a reason for the campaign — maybe some sort of special event, like a birthday or anniversary?

For example, personal campaigns can be effective in helping your board meet your 100% giving goals.

There has been debate about whether giving should even be required for board members, as it necessitates board members to be of a certain income bracket to serve — disenfranchising many already-marginalized groups from nonprofit leadership positions.

Encouraging nonprofit board members to engage in personal campaigns not only helps structure how they network for your organization, but allowing board members to draw on their fundraising networks — while not necessarily requiring them to have all the funds themselves — also ensures more equity in terms of who can actually afford to be on a nonprofit board.

Fundraising Event Ideas for Nonprofits

Say you’ve looked at your data, and it says you make the most money from specific fundraising events — maybe your donors like the glitz of a nice dinner or the raucous fun of a casino night?

If that’s the case, it totally makes sense to keep putting together your fundraising events: No need to fix what’s not broken, after all.

But if you’re looking to do something a little different this year, that’s okay, too! One way you might do things a little differently is by harnessing the power of collaborative fundraising events — “collaboration” has been a buzzword for funders recently, and you might be able to find more sponsors by teaming up with another nonprofit.

Trust me, I hear your disbelief, but other nonprofits have approached fundraising with this collaborative, abundance-based mindset and come out on top — stranger things have happened, after all.

Alternately, you might be thinking of shaking things up by offering an entirely new kind of event when fundraising for your nonprofit.

Maybe you took our earlier message about in-kind donations to heart and now have the material basis for a fun auction? Well, you might want to make sure your nonprofit auction is legally compliant.

And, if you want to make things easier — for both yourself and your donors — you might want to base your materials on the following tax-deductibility samples:

Lastly, maybe what you’ve decided to change isn’t the event itself — but rather, how you plan to fund it.

Nonprofit fundraising events themselves can be surprisingly costly — and you don’t want to end up spending more money than you’re making on the event.

This means you might have to stake out some corporate sponsorships for the event. Start by using extant and/or personal relationships to find these sponsors — possibly even asking your board if they have any suggestions and/or connections.

You might be surprised at the corporations willing to sponsor your event.

After all, some nonprofits have even had success raising money from casinos, which many probably wouldn’t consider altruistic — or even socially impactful — business ventures. But can you imagine any cooler casino night than one actually sponsored by a local casino? Give it a try!

Capital Campaigns

Capital Campaigns usually act as a kind of milestone when nonprofit fundraising. Is it the fifth, tenth, or even 25th anniversary of your nonprofit? Maybe you want to signal something new? Perhaps your nonprofit is pivoting (or expanding) in terms of its trajectory?

Nonprofits often use these milestones as a time to reflect on the past and speculate on future desires. Whatever the goal, however, accomplishing it is going to require some capital.

You can read more on why nonprofits might engage in a capital campaign. Among other resources, this page also offers FAQs and a beginner’s toolkit.

As with all nonprofit fundraising strategies, it’s crucial to have a plan of attack, including thinking through what strategies you will use should you choose to pursue a capital campaign — after all, capital campaigns are a lot of work, and there are few things as tiresome as asking donors for yet more money — even if you really do need to patch that hole in your roof.

So take some time to think through the ins and outs of things to consider before you begin a capital campaign:

For example, property renovation and construction are among the most common reason for nonprofits to undertake a capital campaign.

But if you’ve already thought through all of the various potentialities — and your board is on board — you might consider how to make your nonprofit’s capital campaign a little more fun (and effective): This might include hosting a photo contest or having a consistently generous donor offer a challenge grant to match funds for your nonprofit up to a certain amount.

More than anything else, if you’re going to embark on a capital campaign, you need to think through how you’re going to get the word out: Are you going to use mailing lists, websites, news (or newsletter) articles, flyers, press releases, or hopefully all of the above?

The larger the audience, the larger the pool of potential donors for your nonprofit!

Ideally, if you use social media, for example, you’d want your campaign to go viral. You can use TikTok or Instagram to create video or letter chains that encourage people to share your story — and donate (via GoFundMe). For example, here’s the story of how one nonprofit used video chains to fund disaster relief abroad.

And of course, when nonprofit fundraising social media can also be mechanized to expand your network, everything from formal sponsorships to the more informal information-sharing that gets your story out there.

Donor-Advised Funds (DAFs)

With the rise of the ultra-wealthy, there is research being done on how to engage donors of ultra-high net worth. One of the ways in which nonprofits have sought to engage the ultra-wealthy while fundraising is through donor-advised funds (DAFs).

Essentially, DAFs are when a donor allots a certain amount of money to be dedicated to charitable organizations by using either a community foundation or a financial institution as the go-between; these go-betweens then receive a portion of the money.

Get a More In-depth Introduction to DAFs.

However, a problem with DAFs is that there is little accountability in terms of when the organization actually sees the money. In fact, DAFs have been accused of essentially acting as non-transparent tax shelters for good.

Like most things, the more money you’re talking about, the murkier the legislation (and morality) seems to become.

Endowments

Another form of charitable donation from the ultra-wealthy often comes in the form of endowments.

Endowments usually begin from large lump sums of individual donors (perhaps as part of their estate planning), and the nonprofit can often only tap into the interest earned after administrative fees.

Simply put: You might have a comfortable endowment, but you might not actually be able to use enough (or any) of it — especially if the stock market falters.

Of course, endowments can generate regular income. Discover the good, the potentially bad, and the ugly of endowments.

It explores different types of endowments (including harkening back to the non-endowment donor advised funds) and whether they are right for your organization — especially considering the instability faced by economic crises such as the COVID-19 pandemic.

Essentially, the funds that are generated as a result of endowments are usually highly restrictive and can even result in financial instability (and insolvency) for nonprofits.

If your organization is thinking about an endowment, the author cautions to make sure you still have a sizable amount of cash on hand in case of emergency.

2. Grants: Strategies & Sources for Nonprofits

The second source of funding we will cover is another that most nonprofits are probably intimately familiar with: Grants.

Grants can be a key source of funds for a nonprofit — but getting one can sometimes be a challenge.

Later in this section, we’ll discuss some of the various places you can actually find grants, but for now, we’re going to focus on the bigger picture: Developing a grant strategy.

Grant Strategy

If part of your aforementioned overall nonprofit fundraising strategy includes pursuing grants, you need to make sure you also develop a strategy for how you are going to pursue different kinds of grants.

Much like your donor strategy, your grant strategy should incorporate the use of data, including observing general grant-funding trends. Grant-funding trends often follow general philanthropic trends — recently, for example, trust-based philanthropy has come into the spotlight.

These changes include the shifting of grant-funding paradigms to include more operational support, a welcome change for any nonprofit. And indeed, pursuing grants that fund your nonprofit’s general operating support should comprise part of your holistic grant strategy.

At its core, your nonprofit’s holistic grant strategy should be based on where your organization needs the most resources, be it staffing, technology, or training, among other areas.

Similarly, your grant strategy should provide the funding necessary for your nonprofit to engage in succession planning, capacity building, and, of course, general operating support — all of these can help strengthen your organizational infrastructure and advance equity.

Grant Professionals

But if this all feels like a bit too much, it might be time to hire some grant professionals to help your organization develop — and eventually pursue — its overall grant strategy.

When you’re looking outside your organization, it can be difficult to find a grant professional you vibe with. After all, in terms of a successful nonprofit grant strategy, most of it is about finding the right fit.

Luckily, Blue Avocado has a guide to help you figure out whether or not an outside grant contractor is right for you — you know, instead of relying on vibes alone.

Of course, if you decide to hire outside grant professionals, you’ll want to make sure that you are using them appropriately.

Sometimes, nonprofit executives tend to view grant professionals as magicians, but here’s how you can ensure that you are respecting these integral team members — whether they’re technically outside consultants or not. In particular, this will help you avoid the additional turnover cost of all-too-common burnout within this profession.

For more information straight from the source, check out these interviews with two grant professionals!

Grant Sources

The reality is that there are a variety of different sources of nonprofit grants. However, just like finding the right grant professional, what is most important about grants isn’t actually the source of the grant but making sure your organization is choosing the right grant.

Nonprofits Don’t Have the Time or Energy to Waste Applying for Grants They Aren’t Going to Get

Now that we’ve discussed the importance of pursing a grant strategy — that may or may not include contracting an outside grant professional — it’s important to discuss where a nonprofit might actually find the grants it intends to pursue.

There are many different kinds of grants and grant sources. Here’s some tips for how to find grants and grant resources (including links of reputable databases), how to figure out if a grant is right for you (via a Grant Assessment Checklist), and some cautions about the restrictions and general instability of grant funding.

All too often, nonprofits think grants are a sure thing; but the reality is anything but simple

However, there are some more certain ways that you can locate (and hopefully eventually obtain) grants, including using affinity groups to find grants that fit your nonprofit.

Government Contracts

However, there are a few other nonprofit grant sources that are important to discuss, including some that are important enough to elicit their own subsections.

First is the elusive government contract, the very mention of which probably has most nonprofits hoping beyond hope.

If a government contract is your dream come true, here’s how your nonprofit can turn a government contract into community impact.

On the other hand, here’s what not to do with a government contract for nonprofit funding, which identifies five all-too-common pitfalls nonprofits can fall into in pursuit of these oft-intangible assets.

Collective Giving

Simply, collective giving is a way to combine individual contributions into larger grants. By using foundations — or a similar structure therein — the collective power of these donations can help nonprofits address community needs.

Explore the importance of grantmaking institutions doing their own research into nonprofits so that fundraising can be more equitable.

The article advocates for unrestricted, lower-burden grantmaking that pursues the principles of trust-based philanthropy, reiterating that potential shift in the philanthropic paradigm.

Grant Planning

Now that we’ve discussed some potential sources for nonprofit grants, it is now crucial that we turn our attention to the planning stage.

This will include making sure all relevant stakeholders are involved throughout the grant planning process. As aforementioned, your nonprofit organization might decide to contract outside grant professionals as part of your holistic grant strategy.

But even if you involve outside consultants, it is crucial that the nonprofit grant planning process not be siloed.

That means your grant strategy should involve consulting with everyone on your team, including your program managers (as they will have the practical know-how of program implementation), your board members, and other executive leadership.

In fact, it is particularly crucial to involve your CFO in the grant application process, as they can be integral to aid in budgeting, proposal calculations, and the eventual implementation of the grant itself.

One of the most important — and often overlooked — stages in the nonprofit grant planning process is figuring out what to do after you get the grant.

That is, part of your nonprofit grant strategy must involve making a plan to keep the money you’ve earned. If you don’t have a clear plan of how to keep this money, your funders might think you don’t know what you’re doing, which might make them less likely to fund you in the future negatively affecting your nonprofit fundraising efforts.

This situation might sound terrible but trust me — it’s still a better scenario than having to give the money back, which can happen.

And, if you’re upset about this doom-and-gloom approach, perhaps the schadenfreude of some grantor horror stories will lighten the mood. So even if you mess up in your grant planning or your overall strategy, just remember: Other people have probably messed up worse.

But all joking aside, just because we all mess up doesn’t mean we can’t hold people — like funders, for example — accountable for their actions. So, buckle up: This next section concerns those hard conversations nonprofits and grantmakers need to have if we’re really going to make a difference in this world.

Ways to Pursue Funding Equity

As the boots-on-the-ground of community-based programming, often nonprofits are the ones who best understand what the communities they serve need. But it’s funders who so often set the standards, restricting what can or should be funded or how it will be evaluated.

For nonprofit fundraising funders need to understand that these restrictions and this scarcity mindset aren’t virtues.

Nonprofits can’t adequately serve their communities if they’re being forced to pay employees poverty wages.

So, as nonprofits, we must set boundaries with our funders. We must advocate for self-determination (and against unreasonable expectations) in dictating appropriate terms. This is especially the case for smaller organizations, those led by people of color, and those who feel they are constantly under pressure from funders to scale and/or expand.

Instead, nonprofits must advocate for real-time evaluation while working to use evidence-based practices to show that their programs work.

Perhaps more generally, it might be time to argue against funders setting the rules; in particular, it’s time to argue against funding restrictions. In order to do this, nonprofits need to feel empowered to speak out, to participate — and sometimes even begin — a forthright dialogue that reduces systemic oppression by explaining to funders how they might help fix philanthropy.

And funders must be actively engaged in this conversation instead of passive listeners of nonprofit criticism. For example, you might share this self-assessment guide with your funders to help them become more actively engaged in changing the conversation to fight for funding equity.

However, it is also crucial to remember that there are human beings on both sides of this table — nonprofits and funders alike. The goal should be maintaining an open dialogue between funders and nonprofits so nonprofits can adequately and equitably serve their communities.

To wit, any criticism or feedback must be constructive in nature and work towards building understanding, not breaking relationships apart.

3. Self-Generating Income: Can Your Nonprofit Be its Own Source of Funding?

Self-generating income might be the most nebulous of potential revenue streams.

Part of its mystery comes from the fact that it is referred to by a variety of different names, including “services,” “customer contracts,” “earned income programs,” and “closed-loop funding models,” among many others.

In regard to how income generated is reported to the IRS, it is also referred to as an “exchange transaction” and/or “contract with customers.” However, IRS rules are nothing if not nigh inscrutable: Grants can also fall into this category.

For more of the vagaries associated with accounting procedures, check out FAQ #5.

Essentially, self-generating income for nonprofit fundraising is exactly what it sounds like: The nonprofit generates income through a variety of different sources, perhaps offering rentals, services, or consultancy, for example. In this, the nonprofit functions most closely to a business, in that they are providing something their customers want and charging for it.

Sometimes, self-generating income can be as simple as acting as the go-between for gift card sales, like scrip-selling programs. Other times, nonprofits might provide memberships, like an art museum or a botanical garden. If your nonprofit offers memberships, make sure you’re not making these eight common membership mistakes.

But just because you’ve created an earned income program doesn’t mean you have to fund it yourself: It’s actually great to begin your self-generating income through grant funding.

In fact, getting grantors to invest in earned income programs is crucial for nonprofits to become self-sustaining, making sure that they are continuously able to replicate the funding they need to provide services to their communities.

Self-generating income can be tricky to navigate, but when done right, can be a powerful source of funding for nonprofits.

Services

So where can you find thee mystical pots of money? Well, some organizations, like American Nonprofits, offer loans to nonprofits. Alternately, you might even ask a wealthy board member if they’d be willing to loan your organization money — of course, if that’s available to you (and them).

As previously mentioned, one of the common ways in which to self-generate income is by providing a service for which you charge a fee (or have a fee structure).

The most basic kinds of services for nonprofits to offer are generally those that are embedded. With embedded services, most of a nonprofit’s programming is free, but additional services can be provided for a fee that usually goes towards operational expenses.

In the case of embedded services, nonprofits usually have a grant or rely on nonprofit fundraising in order to pay for their programming, and then use the additional revenue gained from the embedded service to go towards what the grant doesn’t cover — that pesky, ever-present overhead.

However, nonprofits sometimes offer services that are more or less separate from their programming. That is, the programming they offer is funded by a separate set of services they offer to other clients.

For example, a local arts nonprofit might offer free classes to youth but offer a fee-based art consulting services to businesses. In fact, here’s how one small nonprofit generates over 90% of its earned income through this self-sustaining funding system. I’m not saying it’s easy, but it can be done.

Whether you choose to offer completely separate or embedded services, you want to make sure that the services your nonprofit offers are mission-aligned.

To generate income, you need to find your niche within your supporters and the communities you serve.

In this, consider your customer base. What corporations or state actors might benefit from your expertise?

The Social Enterprise

Apart from offering a fee for services, consultancy, or something similar, your nonprofit might also generate revenue through linking itself to a for-profit business. When these for-profit businesses are created for the benefit of nonprofits, they are usually referred to as social enterprises.

However, these are distinct from low-profit, limited liability corporations (L3Cs); for more, check out this comparison between nonprofits and L3Cs.

Like everything else, a social enterprise isn’t as simple as adding a for-profit venture onto your nonprofit organization (or vice versa, for that matter). There are many things to consider before you branch out from the nonprofit into the for-profit world.

Here is an article that speaks to specific considerations nonprofits should entertain before beginning a social enterprise to earn income.

All-too-often, social enterprises can detract from the nonprofit’s mission. As such, one of the crucial first steps before beginning a social enterprise is to make sure you have open conversations about this idea with all relevant stakeholders, including your staff, your board, and the communities you serve.

4. Loans: Borrowing to Further your Nonprofit’s Mission

The final source of nonprofit fundraising we’ll (quickly) dive into might be the most unusual for many nonprofits — and the one we’re the least comfortable with: Loans.

However, instead of thinking of loans as money you’re taking from somewhere else, you might think of it as money that is being invested into your mission.

These kinds of nonprofit loans are actually on the rise and are often referred to as impact investing.

If foundation have money to invest, they don’t want to invest in places whose actions clash with their beliefs. In fact, impact investing is often conceptualized as an alternative to a capital campaign when fundraising for your nonprofit.

With these kinds of loans, you basically must show that there is a social and financial return — although sometimes the social can outweigh the financial, so to speak.

Lastly, you might consider attempting to contract a social impact bond: in this nonprofit loan structure, the government acts as the mediary between private investors and nonprofits so that nonprofits can develop private investors as sources of capital.

Impact & Ethical Storytelling for Nonprofit Fundraising

As mentioned previously, what attracts investors in these loans is the mix between the financial and the social benefits. That means, your organization will need to be able to articulate the impact that these types of loans will have for the communities you serve.

However, in demonstrating this impact, make sure you engage in ethical storytelling. That is, it is crucial that you do not replicate the same systems of oppression you seek to undermine through stories of tokenism and/or saviorism.

In explaining the importance of your organization to investors, it is imperative that you do not exploit trauma for financial gain.

In explaining the importance of your organization to investors, it is imperative that you do not exploit trauma for financial gain.

Instead, seek to honor the people you serve by engaging them in the storytelling process.

5. Corporate Sponsorship

Typically, when we hear “corporate sponsors,” we might think of companies sponsoring a fundraising event, which we discussed previously. But the reality is that nonprofits can obtain corporate sponsorships for any programming or activity they put together.

At their most basic level, corporate sponsorships run on acknowledgement — much like the way nonprofits often thank their individual donors.

But this acknowledgement doesn’t have to be difficult or involve a whole event: It can be as easy as putting the company logo on a T-shirt or dedicating a newsletter page to naming corporate sponsors.

Why Seek Corporate Sponsorships?

Well, you might notice that the more your programming grows, the more funding it requires—and the more unsustainable that funding can seem. This is known as the “Program Growth Paradox” — and it usually results in the dreaded Sustainability Question from funders.

Now, we’re not suggesting that corporate sponsors will not ask you about the sustainability of your programming, but they tend to be more focused on direct advantage as opposed to long-term growth. It’s one of the benefits of quarterly returns: Corporate sponsors tend to hone in on the immediate pay-off, so to speak.

So yes, you can absolutely wax poetically about the long-term benefits of your program for the community, but what you’re really selling is simpler: Name recognition.

As much as they might pretend otherwise, corporations are part of their communities. And if community members have a choice between a company they have seen giving back to the community and a company they haven’t, which one are they more likely to pick? Which one would you pick?

What Companies Should You Seek as Corporate Sponsors?

In pursuing sponsorship, consider the connections to corporations you already have. After all, it is often easier to strengthen extant connections as opposed to building new ones.

These connections might be geographic. Look to the businesses within the surrounding area where your nonprofit is located. Do you have connections or shared interests with any of these businesses? If so, these might be relationships to pursue.

However, these connections themselves also might be relational. Consider the relationships you and your employees have with people who work in these businesses. Think about how you might leverage some of these relationships. After all, people are much more likely to want to work with nonprofit employees they know.

For these businesses, consider who might be your “in”: What internal connections do you have to these businesses?

Perhaps most importantly, you must consider your organizational goals. This means you need to have a plan of approach. This plan should help you define your goals, evaluate your resources, and delineate specific criteria for these sponsorships.

Understanding what you are looking for in a corporate sponsor ultimately helps you to figure out what companies might be most likely to agree to this relationship.

How to Obtain Corporate Sponsorships: The “Sell”

Of course, when you figure out what companies you want to (or would be willing to) partner with, you want to make sure the sell is successful. Every funding strategy you undertake is powered by time and labor, and few nonprofits have those to spare.

Your development people are probably very busy as it is, and you don’t want to send them (or yourself) on a wild goose chase. So, consider how you are framing this sponsorship to the corporation.

From this, it can be helpful to move from a nonprofit mindset of community benefit to one that might be more appealing to business-minded folks: Defining people by their aspirations instead of their problems.

Put another way: People like being associated with successful programs, so speak to what your programming offers instead of what you all are trying to overcome.

However, sometimes it can be helpful to be a little blunt when dealing with the corporate world.

In this, frame your ask as a benefit to their company: Get in your sponsor’s head and help them see how their name on your shirt (or newsletter) benefits their company.

That way, you’re not just asking for support; you are providing them with a tangible gain — often in the form of publicity and soft marketing.

But when it comes to this offer, be careful. You can enter murky legal waters if you agree to advertise for corporate sponsors.

Generally, a name or acknowledgement is fine but stay away from discussing any company products or promising any kind if exclusivity.

And, if you have concerns about what your sponsor is asking of you, talk to the person in charge of your organization’s finances. Even if they don’t know the exact answer, they’ll probably be able to point you in the right direction.

FAQs: Common Concerns about Nonprofit Funding, Fundraising, and other Fiscal Issues

There is no one-size-fits-all strategy when it comes to short-term fundraising for nonprofits, here are 8 ways nonprofits can raise money fast!

How to sustainably grow a nonprofit is a broad concept, and there are many factors and variables to consider. A lot of the time, it might even be best to deploy strategic partnerships instead of unchecked programming growth.

Sustainability can also mean:

Not relying on volunteerism and instead valuing outcomes over input by funding capacity.

Enacting smart programming expansions while resisting the temptation to overextend yourself.

Prioritizing financial viability and fundraising during your strategic planning process.

Just because your nonprofit can grow, does that mean it should? Constant growth can be linked to perpetual instability, so to avoid constant growth, take the time to assess your situation.

Here’s a discussion of the importance of sensible growth (as opposed to unchecked and/or unplanned growth) for nonprofits.

How long your nonprofit plans to work on your mission must inform your financial goals and, in turn, inform your fundraising efforts.

If your nonprofit organization provides community services, you might be hoping to stick around for a while. On the other hand, if you are an organization dedicated to eradicating systemic oppression, you might be hoping for obsolescence after a few years.

Not to worry! See how you might compare exchange transactions to un/conditional, un/restricted donations (don’t panic — you’ll also learn the difference between all of these).