Assessing Financial Health in the Time of COVID-19

COVID-19 created significant economic challenges to nonprofits. Explore the unique characteristics of nonprofits’ financial structure.

Some unique financial characteristics specific to your organization’s financial structure.

COVID-19 has created dramatic changes in the financial markets. Nonprofits such as private schools, universities, museums, religious organizations, and even hospitals have seen unforeseen shifts in operations due to quarantine.

While the Coronavirus Aid, Relief and Economic Security (CARES) Act and other stimulus packages might help, delays and difficulty accessing funds, the economic downturn due to COVID-19, and social distancing restrictions create significant challenges to nonprofits. This article helps point to some unique financial characteristics specific to your organization’s financial structure.

Nonprofits must be able to manage debt, take care of their facilities, and measure liquidity. Liquidity is the amount of cash and assets that a nonprofit can easily convert to case for use.

To understand financial health, there are three basic factors involved for nonprofits of any size.

1. Cashflow

Cashflow is the money coming into the organization for products, services, and grants. Cashflow is an important factor for determining sustainability. An organization with three months or less of cash in-hand to cover expenses will have difficulty managing its financial responsibilities.

2. Daily operating expenses

Daily operating expenses have an impact on both business and program operations. For nonprofits, these would include administrative and fundraising expenses. The daily operating expenses can also include, but are not limited to, rent, utilities, and other established expenses of the organization.

3. Debt

Unexpected deficits and/or difficulty making debt payments are figures that need to be tracked and cannot be ignored. Example of debt are capital expenditures, loans, and bonds.

Managing Your Cash

If your organization has less than three months of cash flow, finding ways to decrease daily operating expenses and debt should be a priority.

Here are some things to think about going forward:

1. Consider shortening time period for financial reviews.

Based on the size and issues of your organization, you might think of shortening the time period between reviews to monthly or even less. Review the budget frequently to check that you are meeting goals. This will help in identifying any unexpected loss in revenue or increase in expenses and allow your organization to respond agilely.

2. Request refunds.

Before COVID-19 arrived at the scene, you likely had 2020 fundraising events planned, with deposits already paid for venues and other expenses such as catering, marketing, online ticket sales, or equipment. Unfortunately, event contracts often specify a limited time frame for returning deposits, and some expenses cannot be recovered. Even where that is the case, follow up with vendors and ask them to relax their policies in light of the current situation. You may be able to retrieve some of what you put down. Check in also with those who had agreed to sponsor your fundraising events. Given the circumstances, they might be willing to donate a part of or even the full pledged amount. Either way, they will appreciate the extra effort in communication.

3. Request removal of restrictions from grantors.

If you receive restricted grant funds, contact the funders and ask them to remove any restrictions on existing grants. Removal of restrictions can allow funds to be used for the emergent needs of the organization.

4. Seek interim relief from lenders.

COVID-19 may create hurdles in meeting organizational debt payments or create an unexpected operating deficit. Be proactive in reaching out to your lenders. They may be able to provide interim relief.

Financial Health Check Tutorial

A few indicators of financial health can be garnered from your last IRS form 990. I’ve provided a basic spreadsheet template that allows you to calculate a few indicators for your organization. To use it, work from your most recently filed Form 990to fill in the following data:

Daily cashflow

This calculation determines how much cash the organization needs per day to survive.

Example:

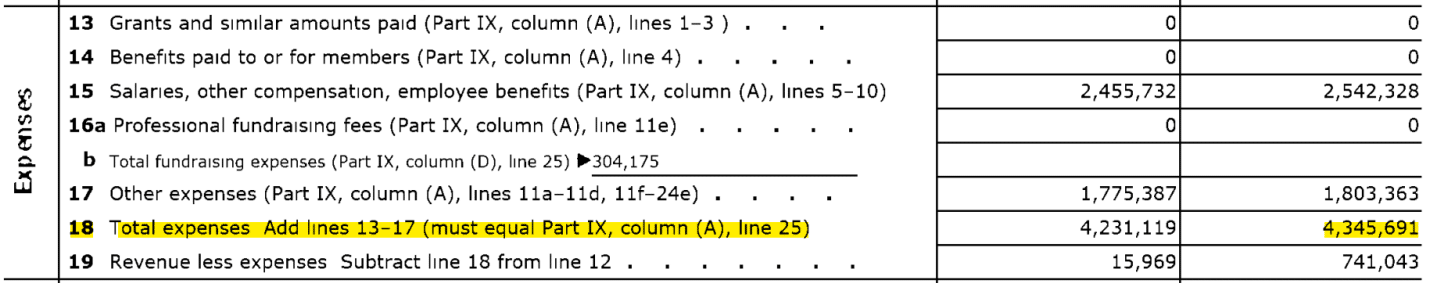

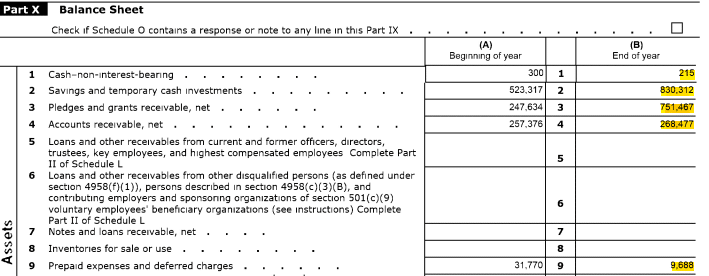

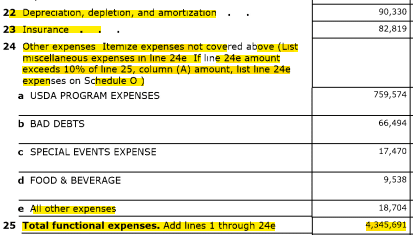

Total Year Expenses: $4,345,691

Total #days: 365

Amount needed per day to survive: $4,345,691/365 = $11,906.00

Cash on-hand

This is the amount of cash an organization has at the end of an accounting period.

Example:

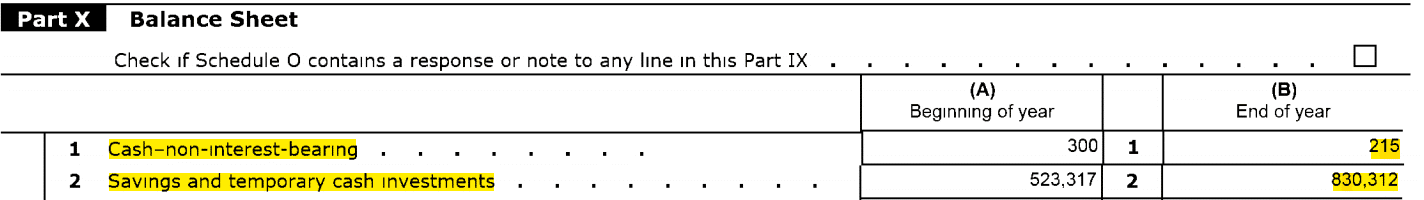

Cash: non-interest bearing: $215

Savings or temporary cash: $830,312

$215+$830312/ 11,906.00 (Daily Cash Flow) = $284.74

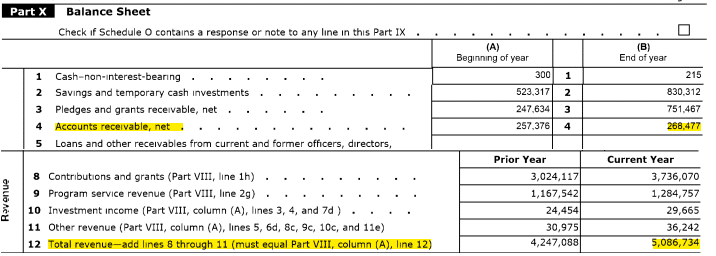

Current ratio

This formula answers how the resources that can be converted to cash compare with future liabilities. This number should be at least 1, but a range of 1.5 to 2.1 is ideal. In other words, for every dollar of liability, there should be at least one dollar (or equivalent assets) available to cover that cost.

Example:

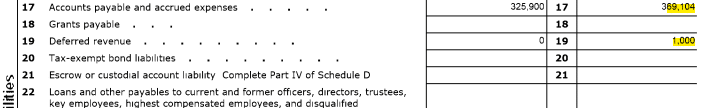

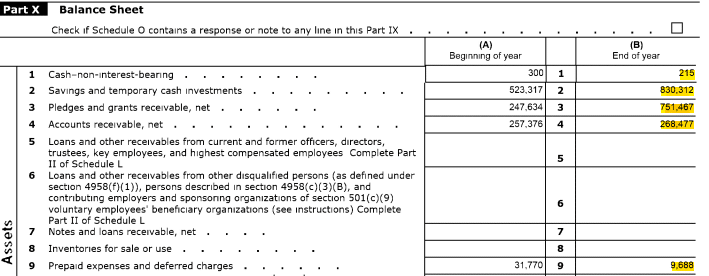

Assets (sum of lines 1-9)/Liabilities (sum of 17-22)

($215+830,312+ 751,467+268,477)/($365,104+1,000) = 5.05

Days cash

This is the number of days that an organization can give out the average size cash disbursements without any cash coming in. Anything less than 10 days signifies a financial red flag.

Example:

Form 990: Part X: Balance Sheet and Part IX: Functional Expenses

Cash & Equivalents X 365/Expenses – Depreciation

(Lines 1 – 2) x 365/ (lines 25A – 22A)

215-830,312 x 365 / 4,345,691 – 90,330 = -72.9 days

Days receivables

This calculates the average number of days it takes for organizations to pay their bills (invoices). It can also be used to measure the average length of time it takes to collect cash fromgrantors such as government agencies or other third-party payers after services are provided and billed. The days receivables should be lower rather than high; however, the average number of days that it takes an organization to collect cash can vary from nonprofit to nonprofit, and can also vary by program.

Example:

Line 4 x 365*/Line 12

268,477 x 365/ $5,086,734 = 19.26 days

These calculations do not represent a complete list, but they can help you figure out the immediate needs of your organization with respect to financial health.

The loss of revenue, coupled with the inability of employees to work, has consequences both immediate and long term for programs, staff, and the organization as a whole. To remain healthy, organizations must be able to pivot—to respond to any one of multiple scenarios with flexibility and thoughtfulness—which in ambiguous times can be extremely difficult. In a deep crisis such as this one, however, the first and most critical issue that nonprofits must face is basic financial health.

You might also like:

- Do Nonprofits Pay Taxes? Do Nonprofit Employees Pay Taxes?

- Your IRS Form 990 Questions Answered

- Treasurers of All-Volunteer Organizations: Eight Key Responsibilities

- An Easy-to-Use Accounting Procedures Manual Template

- A Guide for Private Foundations: Tax Exemption and 990-PF Filing Requirements

You made it to the end! Please share this article!

Let’s help other nonprofit leaders succeed! Consider sharing this article with your friends and colleagues via email or social media.

About the Author

Suja Amir has a background in management, fiscal and forensic analyses, and general nonprofit consulting. She has years of experience in the nonprofit sector and in local government. She holds a B.S in Psychology and a Master of Public Administration from Virginia Commonwealth University. She is a founding board member of two nonprofit organizations, Asian Latino Solidarity Alliance of Central Virginia, The Virginia Coalition on MOC Reform, and has served on many Boards, including Virginia School Readiness Committee; Virginia Complete Count Commission, Virginia Asian Advisory Board; and the Advisory Board Member of Practicing Physicians of America.

Articles on Blue Avocado do not provide legal representation or legal advice and should not be used as a substitute for advice or legal counsel. Blue Avocado provides space for the nonprofit sector to express new ideas. The opinions and views expressed in this article are solely those of the authors. They do not purport to reflect or imply the opinions or views of Blue Avocado, its publisher, or affiliated organizations. Blue Avocado, its publisher, and affiliated organizations are not liable for website visitors’ use of the content on Blue Avocado nor for visitors’ decisions about using the Blue Avocado website.

There is a math error in the “cash on-hand” section. The article shows:

$215 $830312/ 11,906.00 (Daily Cash Flow) = $284.74

However the solution is not 284.74, it is 69.76 (rounded).

830,527/11,906 = 69.76