The Financial Outlook for Nonprofits

Results of a survey of 500 nonprofits on their organization’s financial outlook in 2017.

How are nonprofits looking financially for 2017?

Last month, we included a survey and invited you to share what 2017 was going to look like for your organization’s financial outlook. Almost 500 of you shared your answers — thank you!! — and we’re happy now to share back with all of you what we learned.

Drumroll, please…

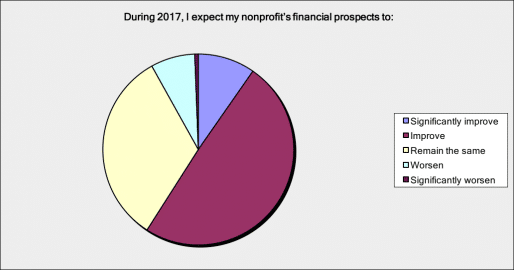

We’re feeling pretty positive overall

Almost six in 10 think your organization’s financial prospects will improve this year. Ten percent expect significant improvement, and just eight percent expect finances to get worse.

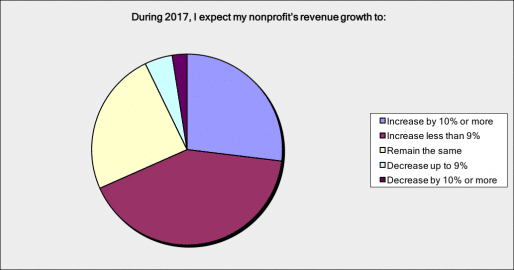

And expect revenue to increase

Fully 93 percent of you expected revenue to stay the same or increase in 2017. And more than a quarter expect revenue to increase by at least 10 percent. That’s good!

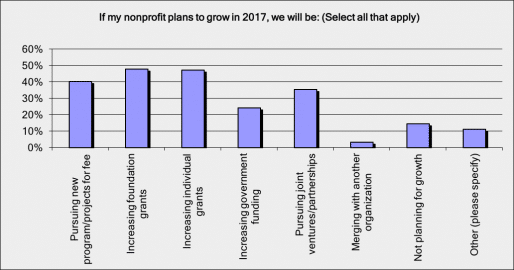

Where do nonprofits expect revenue growth to happen?

Nonprofit organizations in the survey are a diverse lot. Nearly half expect more foundation and individual support in 2017. Four in 10 are pursuing new earned revenue, and nearly the same number are looking to grow through partnerships.

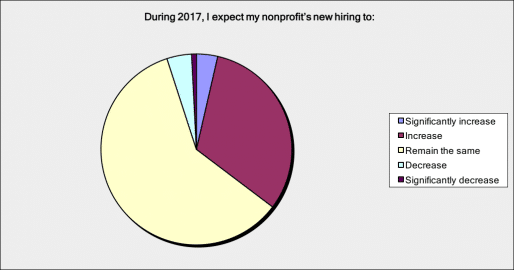

Will this lead to more hiring by nonprofits?

For now, organizations are being conservative About 60 percent of you expect to see no change in new hiring this year. About a third expect new hiring to increase.

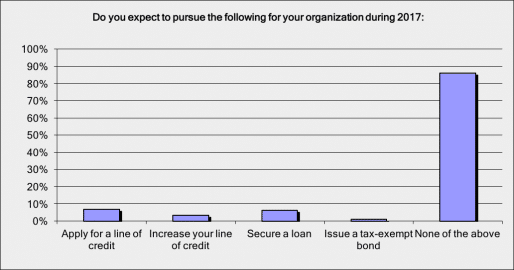

Will nonprofits take on new financing this year?

About one in six organizations expect to pursue new financing this year, with the most common plan being to apply for a line of credit or to secure a loan.

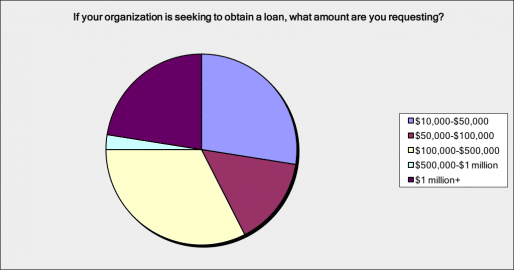

Big loans and small loans

Organizations of all sizes expect to seek a loan. About 22 percent expect a $1+ million loan, and about 27 percent expect a loan of less than $50,000.

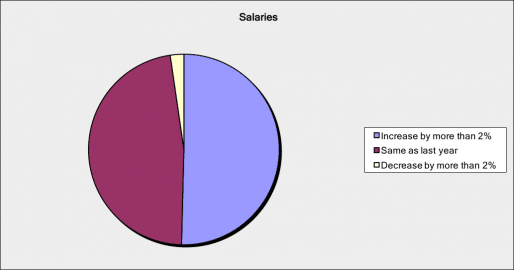

Nonprofit salaries are rising (at some organizations)

Slightly more than half of you report that salaries will increase this year by more than two percent. Slightly less than half report salaries will be flat.

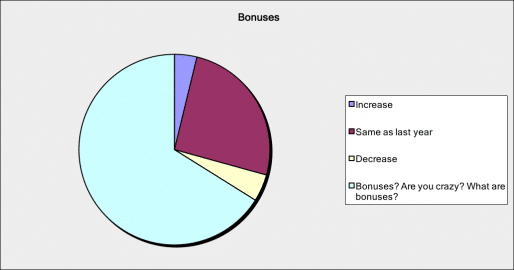

Few bonuses in the nonprofit sector

Two thirds or organizations report no year-end bonuses. (“Bonuses? Are you crazy? What are bonuses?”) And among the third who do get bonuses, few expect to see any change from previous years.

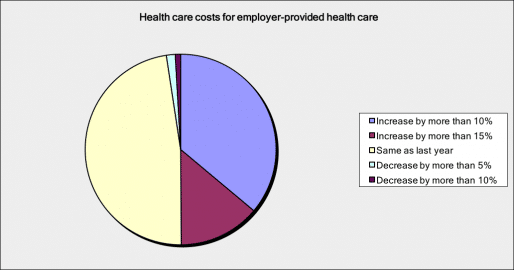

What about health care costs?

Health care costs are expected to fall at a few organization, but for the most part, costs are rising across the sector. Nearly half of organizations report health care costs at least 10 percent higher this year.

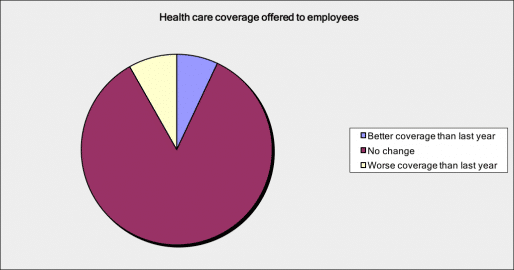

Are health care benefits changing?

Those cost increases aren’t changing the benefits offered, for now. More than eight in 10 of you report no change in health care benefits in 2017, with about an equal number reporting better coverage or worse coverage.

About the Author

Blue Avocado is an online magazine fueled by a monthly newsletter designed to provide practical, tactical tips and tools to nonprofit leaders. A small but mighty team of committed social sector leaders produces the publication, enlisting content from a wide range of practitioners, funders, and experts.

Articles on Blue Avocado do not provide legal representation or legal advice and should not be used as a substitute for advice or legal counsel. Blue Avocado provides space for the nonprofit sector to express new ideas. Views represented in Blue Avocado do not necessarily express the opinion of the publication or its publisher.

While I see validity to most of these results, I wonder about the impact of our recent elections and the changes in legislative leaders and how their decisions will influence nonprofit funding overall…

I found this a bit too optimistic. The area of service clubs’ increasingly losing members without replacement is frightening.

In terms of level/volume of capital received this year (or expected), I’d like to see a question that digs a bit deeper into the trend of restricted vs. unrestricted funding? What percentage of respondents expect to receive more restricted capital year-over-year? And, what is the overall breakdown of the restricted capital as a percentage of total funding?